Australia’s largest aluminium smelter – Tomago Aluminium, located near Newcastle, NSW – has begun formal consultations with employees on its potential closure in 2028.

The news has attracted strong industry attention because Tomago accounts for around 10–12% of NSW electricity market’s total electricity demand, operating continuously and consuming roughly 950 MW of power. It is currently supplied by AGL Energy under a contract that expires at the end of 2028.

What’s Happening

Tomago Aluminium, controlled by Rio Tinto, has indicated that future electricity prices are not commercially viable once its existing contract ends. Despite government assistance offers, no long-term power deal has been secured.

While no final decision has been made, both Rio Tinto and shareholder Norsk Hydro have suggested that continuing operations beyond 2028 could be difficult without affordable renewable energy at scale.

Why It Matters for Energy Markets

If Tomago were to close, the National Electricity Market (NEM) could see a sharp drop in NSW electricity market demand from 2029 onward.

That could lead to:

- Softer wholesale electricity prices, especially in off-peak and shoulder periods

- Downward movement in ASX NSW base futures beyond 2028

- Less pressure on coal generation, at least in the short term, before new renewable and storage projects absorb capacity

The Other Side of the Story: Broader Impacts if Tomago Closes

While lower prices may sound positive, the loss of such a large industrial load could also bring challenges for the grid and other consumers.

If Tomago Aluminium closes:

- There could be a significant drop in electricity demand in NSW – likely around 10% of total state demand (depending on timing and whether the load is replaced).

- This change could have both positive and negative effects: positive in that pressure on generation might ease; negative in that it could reduce grid stability, hurt network cost recovery, and potentially raise costs for other users.

- For industrial energy markets, it highlights a warning that energy-intensive customers may exit if electricity supply becomes uncompetitive – creating a cycle of lost load and rising costs for remaining consumers.

- For grid operators and networks, it could require re-planning generation mix, transmission infrastructure, demand-side management, and reliability frameworks considering the changed demand profile.

The potential closure therefore represents a major structural shift for NSW’s energy and industrial landscape, not just a pricing story.

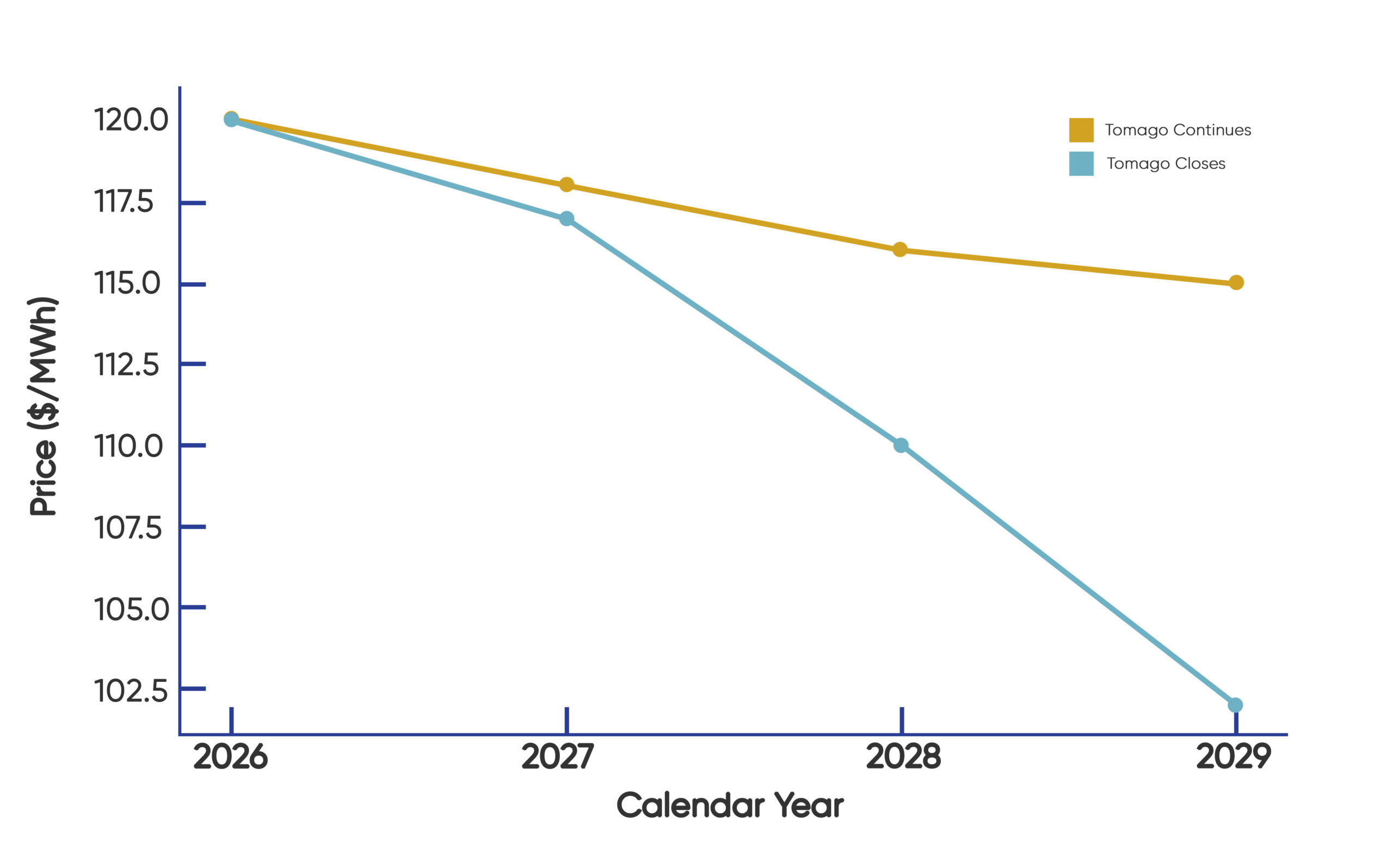

Illustrative Impact on NSW Futures

Below is an indicative look at how ASX NSW base futures could evolve under two scenarios:

- Tomago Continues (no closure)

- Tomago Closes after 2028

(Illustrative data only – for commentary purposes)

Under a closure scenario, NSW forward prices beyond 2028 could ease by $5–15/MWh, reflecting reduced demand in the market.

What This Means for Customers

While these developments are significant, they don’t change the importance of active energy management.

Energy markets remain volatile, and shifts in industrial load, supply, or policy can quickly reshape price forecasts.

Working with an experienced energy consultant ensures you:

- Stay informed about market-moving developments like this

- Benchmark and time your contracting decisions strategically

- Secure competitive agreements aligned with your risk and budget objectives

Our Commitment

We continue to monitor events around Tomago Aluminium and other major market drivers closely.

As the situation evolves, we’ll keep you updated with clear, fact-based insights to help guide your energy decisions confidently.

Stay Ahead of Market Shifts

If your energy contract is due for review in the next 6–18 months, now is the time to start planning.

Our team tracks these developments daily and can help you identify optimal timing, structure, and strategy for your next energy agreement.

Get in touch with your account manager or contact our energy team to ensure your business stays ahead of these market changes.

Get advice from our Energy Management Consultants

Krystle Will

Energy Management Consultant

Get in Touch

Feel free to call or e-mail us. Or just fill in the form below and we’ll contact you for an obligation-free discussion.

Are you ready to save on business energy costs?

Get Started

Leading Edge Energy is proud to be a signatory of the National Customer Code for Energy Brokers, Consultants and Retailers.