Energy price volatility has crept back into the electricity futures markets after a short period of relative stability. The easing of lockdown restrictions combined with some minor unplanned outages sent prices soaring off noteworthy lows before stabilising and then falling again in mid-June. Increased volatility, overreaction to small news events and the lack of any clear up, the down or sideways trend reflects an uncertain and jittery market. Until some reliable information about the short to medium term recovery from COVID-19 emerges, these market mood swings are likely to continue.

Skip the drama and lock in affordable energy prices now.

Indicative retail prices*

| Indicative Rates | NSW | VIC | QLD | SA |

| Peak | 6.0c/kWh | 5.5c/kWh | 4.9c/kWh | 6.5c/kWh |

| Off-peak | 5.0c/kWh | 4.0c/kWh | 3.9c/kWh | 4.5c/kWh |

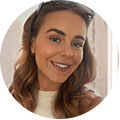

New South Wales

Key Points:

- NSW has seen increased energy price volatility with swings of around 7.5% as the market reacts to the easing lockdown and unplanned outages.

- The future calendar years are trading around $55/MWh, the lowest that has been seen since Hazelwood was in the market.

How did supply and demand affect price?

- Colder winter temperatures drove demand up with peak periods consuming around 11000 to 11800 MW.

- Spot prices were relatively stable for most of the month with two notable NEM wide spikes on the 9th and 10th respectively.

- In NSW prices reached $2195 and $1134/MWh amid high demand and low wind output.

- On June 7 two units at Vales Point Power Station tripped in an unplanned outage, however, low demand at the time prevented a spot price spike.

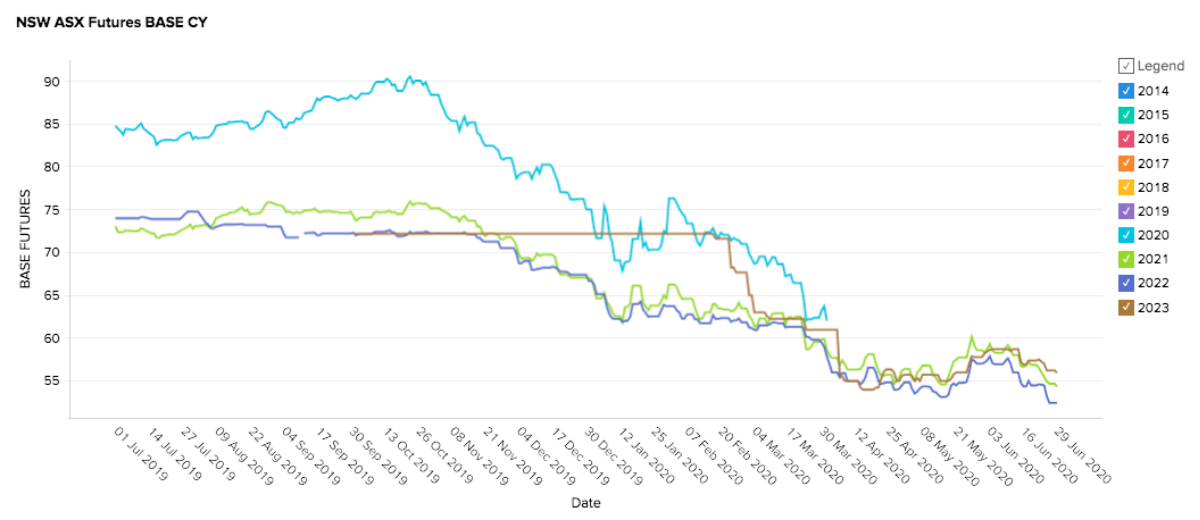

Victoria

Key Points:

- Futures prices have started climbing off some exceptional lows.

- Prices for 2022 and 2023 are diverging from 2021 with the market showing a lot of optimism for the latter years.

- The current price is between $50 and $47 for 2022 and 2023 represents a hefty discount on historical prices.

How did supply and demand affect price?

- Demand peaked at around 7500 MW with a corresponding spot price spike of $2300/MWh on June 9.

- Wind production was solid especially in the latter part of the month when it contributed up to 22% of the state’s energy needs putting downward pressure on spot prices.

- Low wholesale gas prices contributed to soft spot prices.

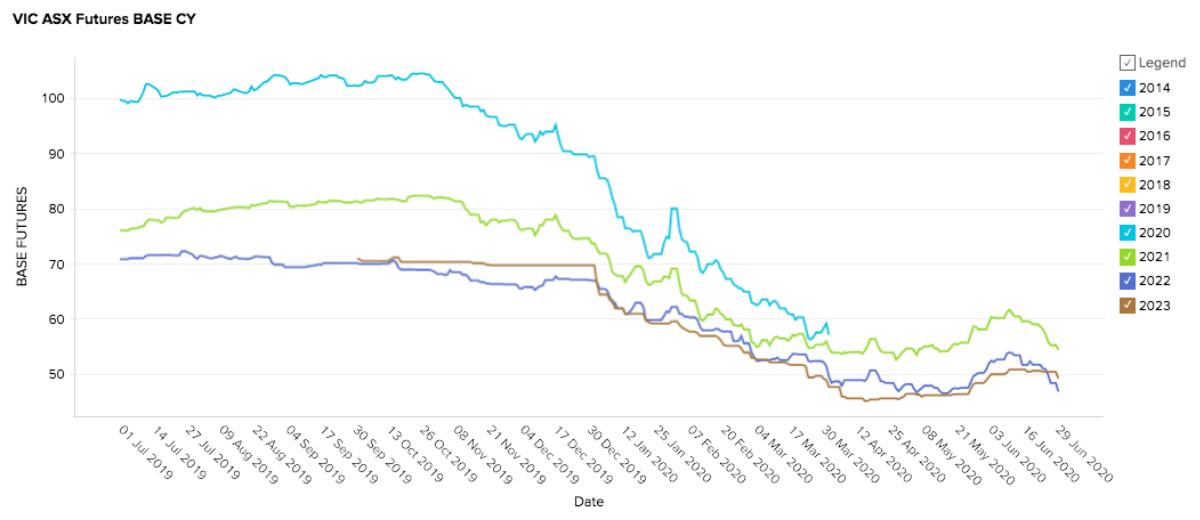

Queensland

Key Points:

- Queensland prices have been less volatile than the other states and are still tightly consolidated below $43/MWh.

- The historical price range for these contract periods is $48-$75/MWh.

- Most of the future calendar years are sitting at $40/MWh, with CY2022 now in the $39/MWh range, a remarkably low price.

How did supply and demand affect price?

- Demand peaked around 7500 MWs as cooler temperatures increased the demand for heating.

- June is the leanest month for solar production with the winter solstice now behind us.

- Solar production fell but was still substantial enough to produce negative prices between 10 am and 1 pm on several days.

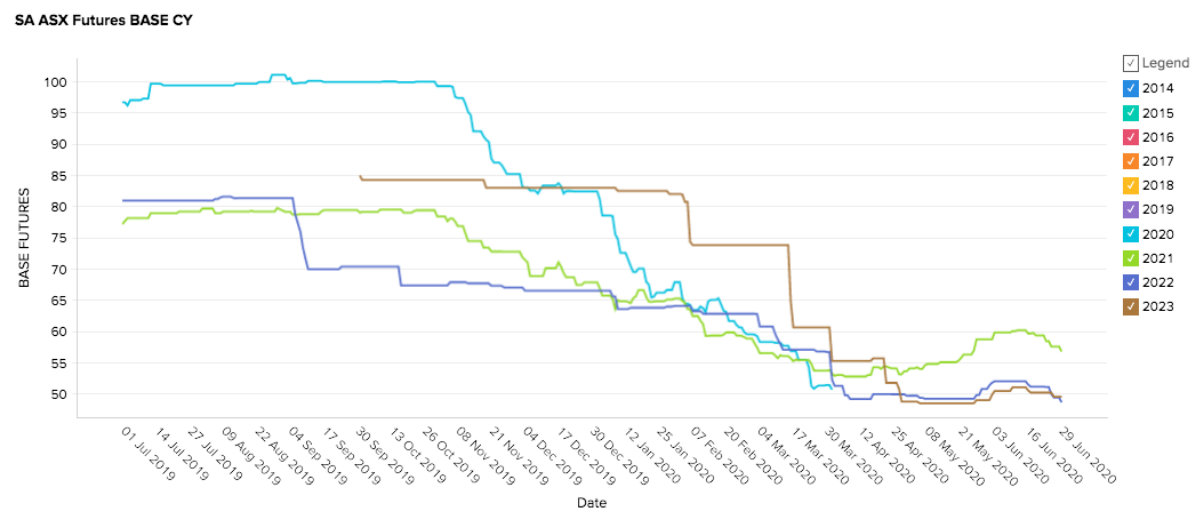

South Australia

Key Points:

- 2021 prices have climbed 13% off the low of $53/MWh in mid-April to around $57/MWh.

- 2022 and 2023 have remained close to all-time lows and currently, site below $50/MWh.

- All periods are still trading well below historic prices despite gains in recent weeks.

How did supply and demand affect price?

- As in other states prices spiked on the 9th and 10th as a cold front sent demand soaring.

- Demand peaked at 2500 MWs on June 9.

- The Hornsdale Power Reserve (Tesla big battery) discharged 429 MWh over the 3-day cold snap from 9-11 June compensating for low wind production.

- Wind production picked up in the latter half of the month with a massive 77% of SA’s energy needs being met by the wind on June 13 and above 65% on several other days.

In Summary

It has been a quiet month in an otherwise unrelenting 2020. Futures markets are listless, awaiting news and lacking any clear direction. With the virus forcing a backlog of generator maintenance it is likely we will see outages increase in the near term and this may drive further energy price volatility in the absence of more meaningful news.

We believe businesses should act now to lock in low prices while they last.