Wholesale electricity prices on the National Energy Market have bucked a two-month downward trend and prices have pushed back upwards substantially in all states under review.

Victoria and Queensland experienced a spike of 6.8 and 5.3 percent respectively as of 9 August from July 1. Futures prices also increased in South Australia and New South Wales by 5.1 and 4.7 percent respectively.

On average, prices have increased by an of 5.5 percent in all states under review. Wholesale prices are still up 73 percent more expensive than they were 24 months ago.

Futures prices in all states under review were trending downwards by a few percentage points in June and early July, mostly due to the number of large-scale renewable energy projects coming on stream in the first half of 2018.

However, that trend began to reverse itself towards the second week of July as the National Energy Market experienced a contraction of generated electricity due to the failure of a number of coal-fired plants.

Over the week ending Friday 8 June, 4,700MW of coal units across the Eastern states failed. Bayswater had three units out, the ageing Liddell generator had one unit out and Mt Piper had one of its two units out, while the Vales Point coal generator also had one of its two units out.

This caused spot prices to skyrocket, and over the two following months, this has flowed into contracted rates – with South Australia and Victoria being hit the hardest.

Another factor that is contributing to the current increase in prices is the fact that the long-term weather forecast shows continuing drought and hot and dry conditions. This means that there is less hydro generation available and electricity demand is also higher due to the increased use of air conditioning units.

Interestingly, AEMO has published a report stating that coal-fired power plants should not be replaced when their shelf life expires over the next 20 years because new fossil fuel investment would have no hope in competing against cheap, abundant and cleaner renewable source energy.

AEMO also stated that the most cost-effective transition would be for coal power to remain in the mix until the power station fleet is put into retirement.

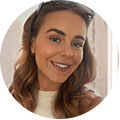

New South Wales

New South Wales experienced a wholesale electricity price increase of 4.7 percent from 1 July to 9 August. That upward trend accelerated markedly in the last fortnight.

Prices are still 38 percent higher than what they were in 2016. This is reflected in the rates that are currently being offered by retailers to large market electricity customers in New South Wales.

Another issue which was flagged in the AEMO report is that Australia needs more interconnectivity to allow for the distribution of renewable energy which is in the pipeline. Most solar farms are situation in rural areas and the New South Wales government has announced that it will be building the infrastructure needed to service three renewable energy generation zones it has identified for development.

New South Wales and South Australia are also planning to build an interconnector between the two states, which should see exports of wind and solar generation to NSW. On the flipside, if supply is short in South Australia, it will be able to import electricity from NSW, rather than relying solely on the Victoria interconnector.

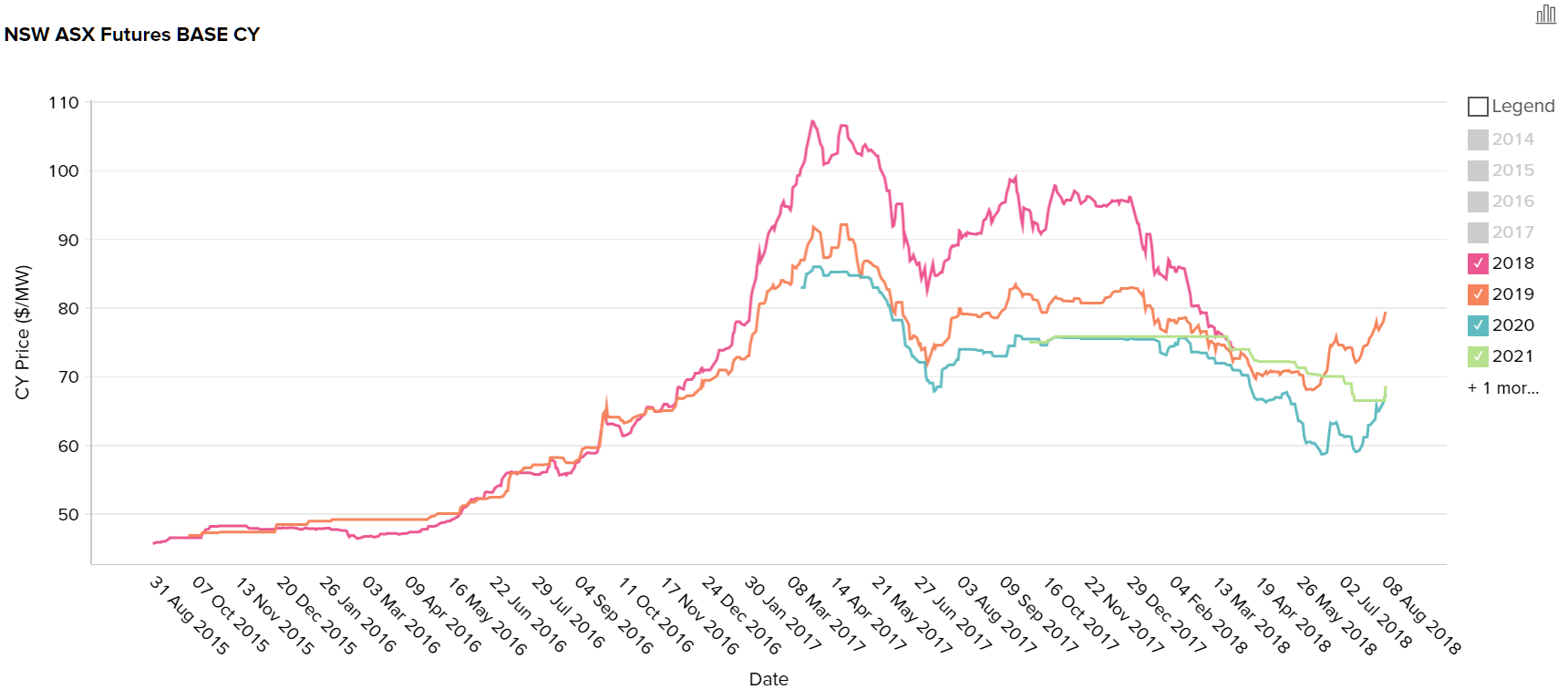

Queensland

Futures prices in Queensland increased substantially from 1 July to 9 August, at a rate of 5.3 percent. Like the rest of the market, the upward trend began in early July and continued to climb through late July and into August.

Wholesale futures prices in Queensland are 11 percent higher than what they were in 2016. This is reflected in the rates that are currently being offered by retailers to large market electricity customers in Queensland.

Queensland’s electricity demand is satisfied largely by black coal generation (6,300MW).

While heavily dependent on coal, Queensland has 2,093 MW of renewable energy projects currently under construction and aims to have 21 percent of its energy needs met by renewable sources by 2021.

Queensland’s rural farmers have been hit hard by the drought and demand for electricity for irrigation pushed demand, and therefore prices, up even further.

Queensland was also the worst state to be hit by energy ‘gaming’ and estimates show that it cost energy users $2.3 billion over a four year period.

The main culprits were state-owned energy generators Stanwell and CS Energy. The State Government intervened and Energy Minister Josh Frydenberg said that prices had dropped 25 percent since then.

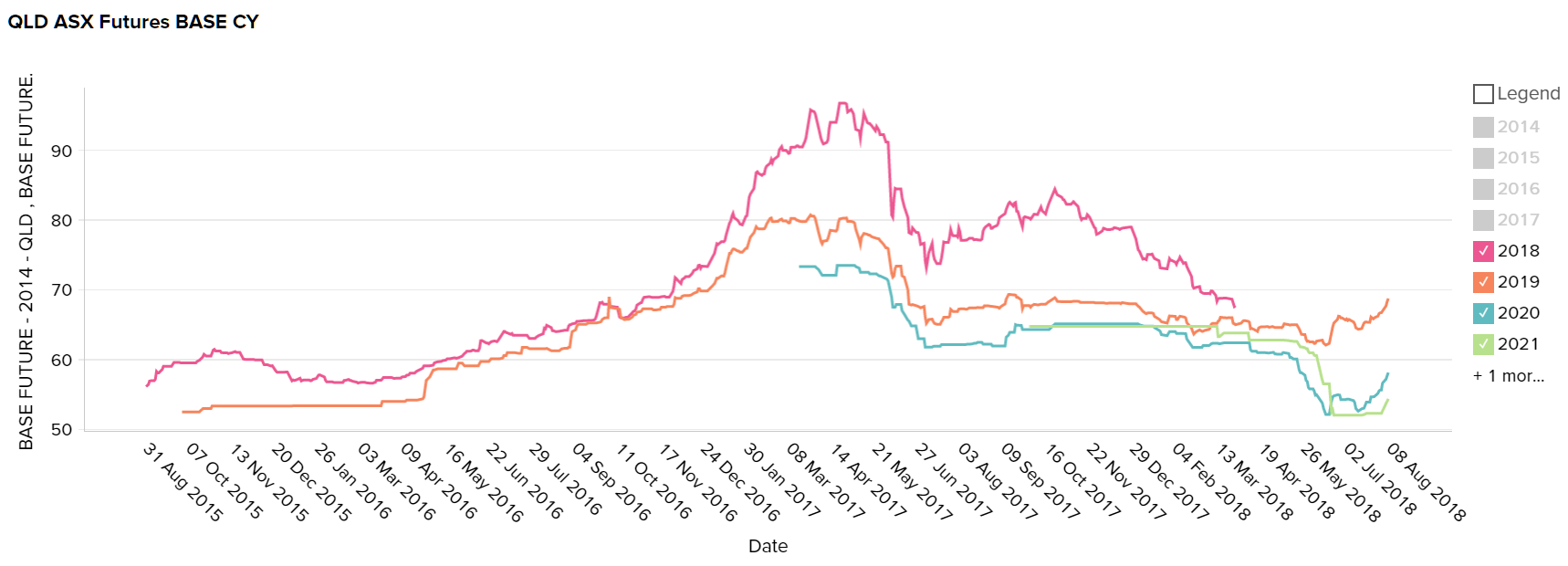

South Australia

South Australia became the first state in the Commonwealth to experience a wholesale electricity price drop to take futures to pre-energy crisis rates. In early July, the state recorded a drop of 1.7 percent since 15 June, with futures prices at the time 1 percent cheaper than they were 24 months ago. The trend was bucked slightly in the first couple of weeks of July, sneaking back up by 0.3 percent.

That trend gathered momentum and South Australia is now paying futures prices which are 5.1 percent higher than they were on 1 July. This is reflected in the rates that are currently being offered by retailers to large market electricity customers in South Australia. Wholesale futures prices in South Australia are now 1.5 percent more expensive than they were 24 months ago.

South Australia is regarded as one of the world leaders in renewable energy projects with 664 MW of wind and 175 MW of solar generation in the state. However, it is still reliant on costly gas generators, which supply in the region of 600 MW of power.

The state has a huge pipeline of solar, wind and battery storage projects lined up as the cost of building them continues to drop sharply.

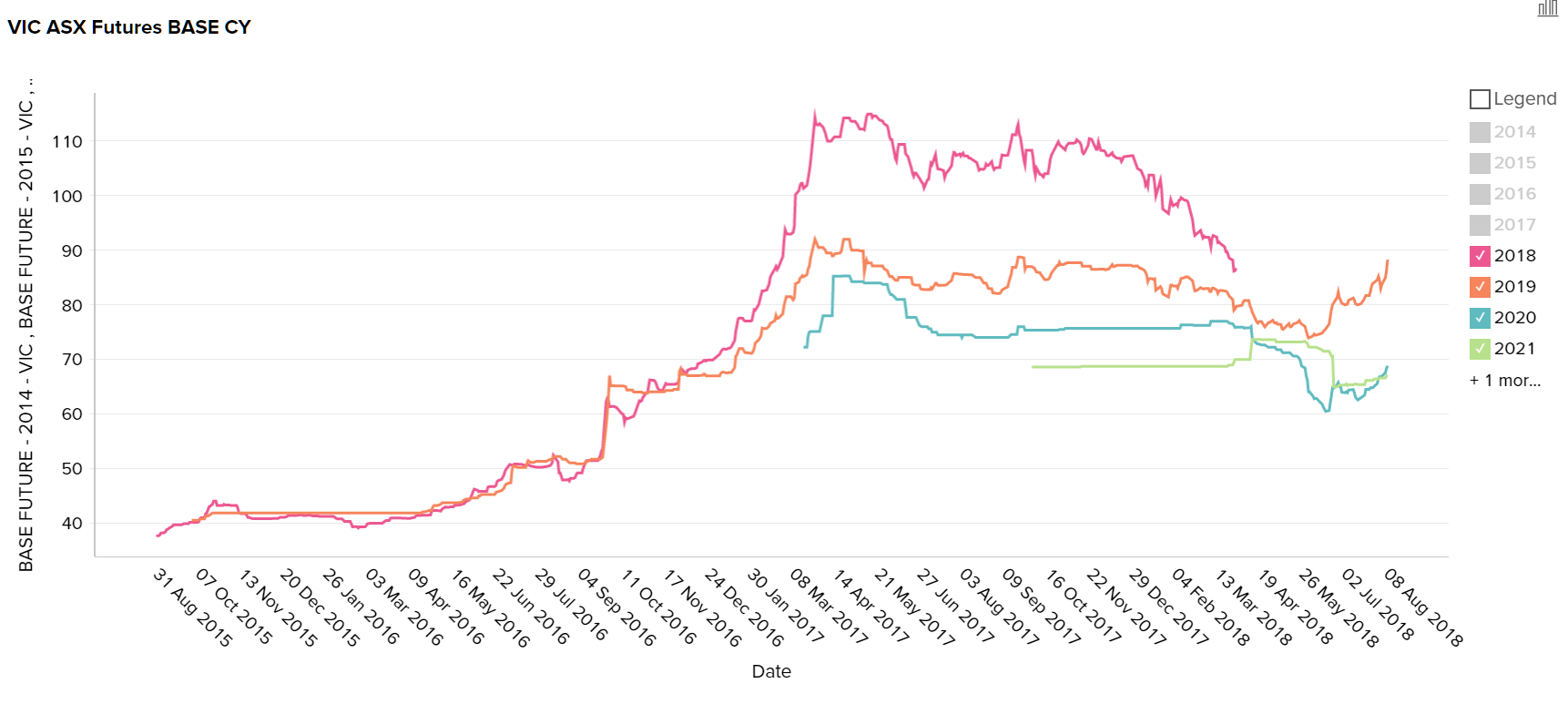

Victoria

Victoria was the state which was hardest hit by spikes in wholesale electricity futures prices. The rates have gone up by almost 7 percent since 1 July. Because of the reliance on the interconnection to Tasmania for peaking power, which went down for a short period recently, the market is pricing in the risk that the interconnector may go down during the Summer peak

In the first week of August alone, Victoria experienced a price hike of 1.7 percent. This is reflected in the rates that are currently being offered by retailers to large market electricity customers in Victoria. Prices in Victoria are still almost 73 percent higher than they were 24 months ago and remains to be the state which is experiencing the biggest price increase since the energy crisis kicked in in 2016.