Fresh worries about the potential closure of Alcoa’s aluminium smelter in Portland could force EnergyAustralia’s Yallourn coal plant to close early and cause an electricity price spike in Victoria.

Victoria has become the most expensive state when it comes to electricity futures prices, which was precipitated by the closure of Hazelwood back in March 2017.

The state has never really recovered and prices have recently been driven up steeply by a combination of the Basslink Interconnector developing a fault as well as outages at Loy Yang A’s coal generation unit and the Mortlake open cycle gas power plant.

The Victoria electricity price average stood at about $102.70 per megawatt-hour in the September quarter was 57 percent higher than Queensland’s.

Current situation

Energy Australia’s Yallourn 1,400 MW plant supplies around one-fifth of the state’s energy requirements and the Alcoa Smelter draws 10 percent of total output.

The Alcoa smelter is racking up huge losses and $240 million in state and federal subsidies are set to expire, raising questions about whether bosses will seek an extension or cut and run.

The taxpayer-funded bailout for the Portland smelter is widely seen as having worsened the market impact of the Hazelwood shutdown, driving up prices across the NEM.

Analysts say that allowing Portland to close as planned would have helped keep a lid on prices and maintain reliability after the loss of that generator.

EnergyAustralia is expected to retire the ageing fossil burning generator in 2032.

What could happen if Yallourn closes early?

Renewable energy costs roughly the same to generate as traditional fossil power plants. Generation and distribution prices currently stand at around $50 per MWh.

However, the challenge lies in storing the energy to be used when the sun is not shining or the wind is not blowing – which is generally at night.

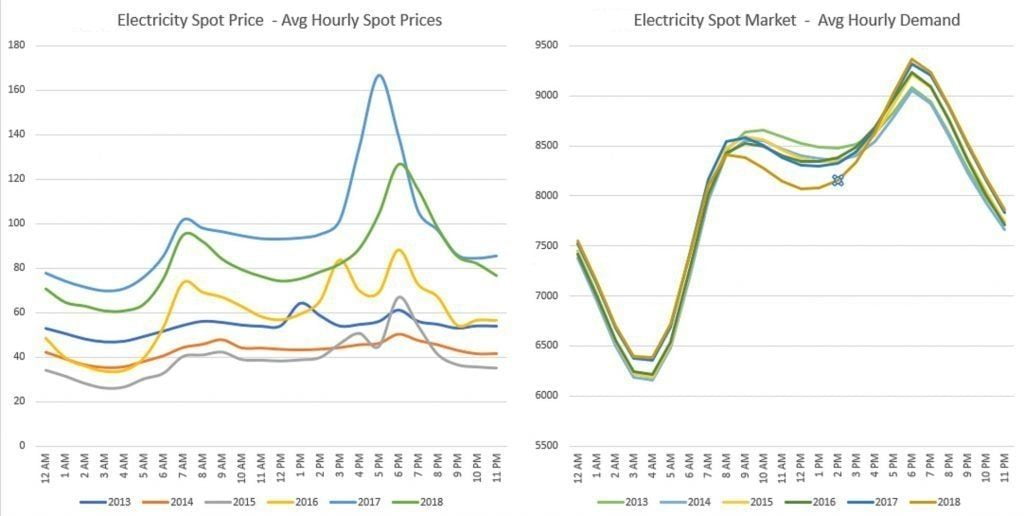

Plentiful daytime solar and wind generation is leading to the hollowing out of the artificial floor pricing structure of the National Energy Market.

Coal-fired plants suffer from inertia and cannot supply electricity as soon as they are switched on. Gas high-peaking plants can meet demand almost immediately, but gas is very costly.

In order to remain profitable, coal-fired plants need to be in operation 24-hours a day.

Given that daytime renewable generation chips away at wholesale prices, fossil generators then charge super high prices at night.

The effect of volatility on prices and the ‘Duck Curve’

This is what is referred to as the Duck Curve. The Duck curve comes about as a direct result of renewables flooding the market during the day, leading to extremely high spot prices at night, which in turn impacts wholesale futures prices.

You can read more about the relationship between spot and wholesale futures prices in this analysis.

The potential closure of Portland is a double-edged sword for Victoria, where concerns around supply shortfalls this summer due to plant outages have helped propel wholesale prices to the highest in the National Electricity Market in the last six months.

While its shutdown would loosen up the balance between supply and demand with 10 percent more of Yallourn’s energy being available to the market, the impact could bring forward its closure, which has triggered worries of a repeat of the Hazelwood scenario.

However, others suggest the exit of Portland would lessen the need to run Yallourn hard to meet demand, reducing strain on the plant and potentially keeping at least some of its capacity in the market longer.

Another school of thought is that the exit of Portland will increase exports to NSW rather than drive the closure of a unit at Yallourn, at least in the short term.

About Leading Edge Energy

Leading Edge Energy is an energy cost reduction consultancy. We assist our clients by applying a holistic lens to your energy costs whereby we guide you through the complete energy cost reduction cycle from rates minimization to energy efficiency, solar generation and battery storage.

Our initial review and assessment process is a complimentary service and you are not obliged to accept any offer that we recommend to you. Call us today on 1300 852 770 or e-mail us at hello@leadingedgeenergy.com.au to get a quote from our Energy Experts.