Market wrap: Temperatures around Australia have started to warm up and that has led to lowered demand as people turned down their heaters, but futures prices are still trending upwards.

The Bureau of Meteorology issued an El Nino alert in October, meaning there is now a greater than 70% chance of an El Nino forming this spring. This forecast for a hot, dry Summer is adding a significant risk premium into 2019 electricity rates.

Other drivers that affected the NEM in September included government inaction on energy policy, drought and unplanned outages at coal-fired power plants all pushed futures prices upwards.

Forecast El Nino send futures prices climbing

The El Nino forecast brought about an increase in futures prices for the month of September. El Nino is associated with reduced rainfall, hotter weather, shifts in temperature extremes and increased fire danger.

The hotter temperatures, combined with the risk of continued record-breaking drought sent futures prices climbing upwards. Rainfall continued to be well below average, impacting hydro storages and irrigation requirements.

Snowy slowed down to just 198 GWh of power in September, compared to an average of 540GWh between April and August.

Generation feeding into both NSW and Victoria from Snowy generators reduced by 60% in September from last month.

Storage levels at Snowy are very low with Lake Eucumbene, which powers the generators, at only 21.1% capacity. This time last year, the lake was 38.8% full.

Forecast demand is expected to climb even further due to expected hot and dry temperatures.

Government inaction spooks the NEM

Government inaction on energy policy has caused futures prices to jump in all states under review in September. At one point, prices climbed by 5 percent in the space of a week.

The NEM continues to be spooked by the lack of any action and the contradicting noises that are coming out of Canberra.

The government has shelved the National Energy Guarantee and has also said that coal still has a future.

This has been contradicted by the AEMO Chief and energy generation companies which have stated that renewables are cheaper than coal and that it should be phased out once the last existing coal-fired power plant is taken offline in 2048.

Temperature and demand across the NEM

Brisbane and Sydney were three degrees warmer than August, which led to lower demand for heating. Melbourne was two degrees warmer while Adelaide was one degree warmer.

The average demand for energy in September was lower by up to eight percent in September.

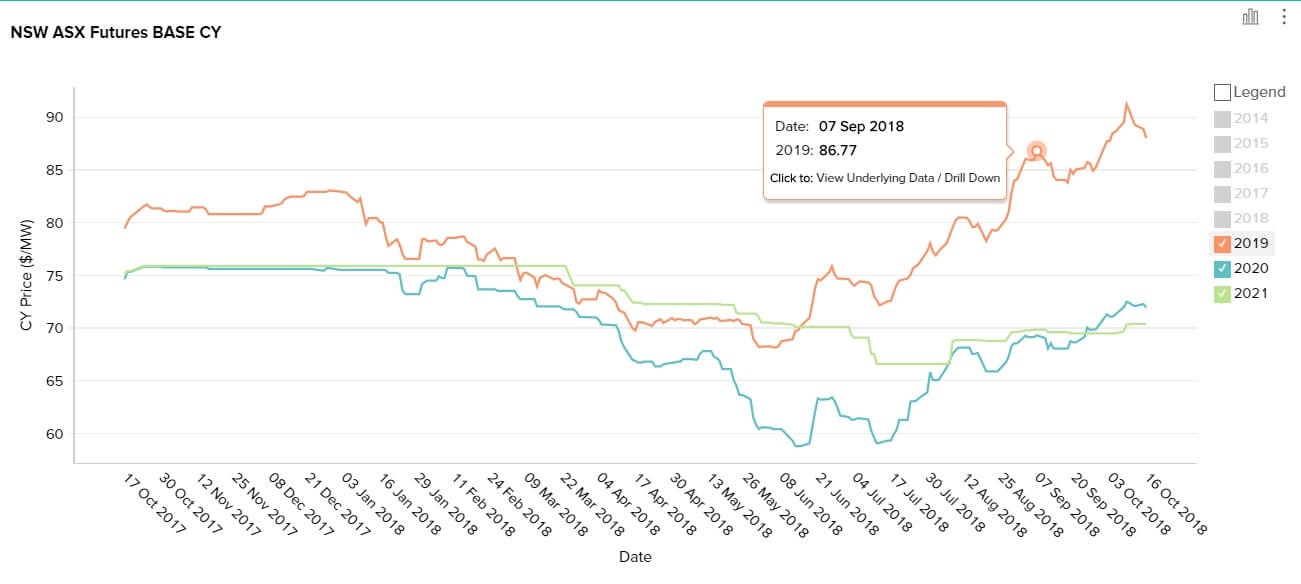

New South Wales

Generation in Australia was lower in September when compared to August. New South Wales had a particularly slow month due to outages at black-coal fired power plants. Half of these outages were planned (maintenance etc.) and these do not affect futures prices as they are factored into the production equation.

Generation in Australia was lower in September when compared to August. New South Wales had a particularly slow month due to outages at black-coal fired power plants. Half of these outages were planned (maintenance etc.) and these do not affect futures prices as they are factored into the production equation.

Peak Futures price (September):

2019: 9.2c per kWh

2020: 7.2c per kWh

2021: 7c per kWh

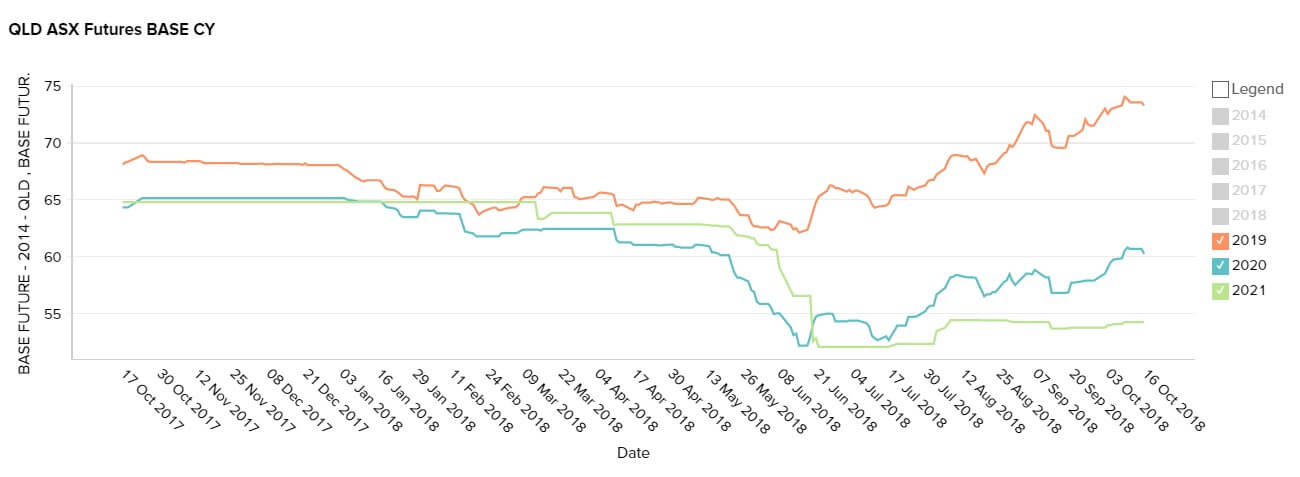

Queensland

Interconnector flows across the NEM were directed towards NSW and Victoria due to thermal station outages. Flows from Queensland were consistent throughout the month, averaging 640 MW south.

Interconnector flows across the NEM were directed towards NSW and Victoria due to thermal station outages. Flows from Queensland were consistent throughout the month, averaging 640 MW south.

Peak Futures price (September):

2019: 7.2c per kWh

2020: 5.8c per kWh

2021: 5.4c per kWh

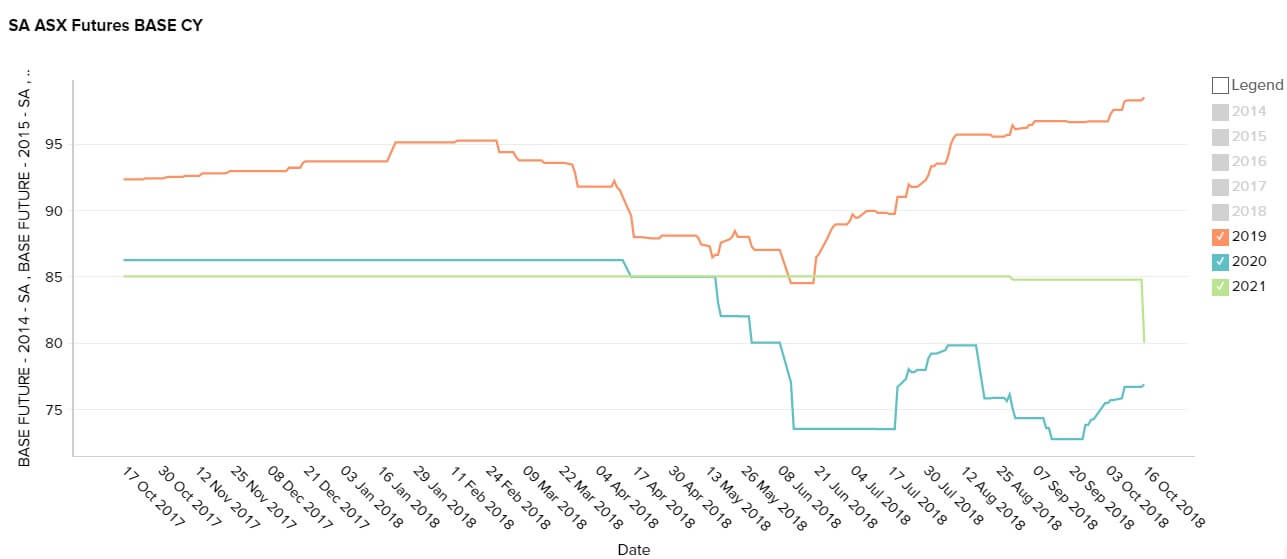

South Australia

South Australia saw available generation plummeted by 17% when compared to August, however, wind generation increased. While South Australia’s interconnector was largely unconstrained, the reduction in generator availability did not unduly affect prices.

In fact, average energy prices in South Australia were either on par or slightly lower than Victoria’s for the month.

Peak Futures price (September):

2019: 9.7c per kWh

2020: 8c per kWh

2021: 8.5c per kWh

Victoria

Victoria’s thermal generation was about seven percent lower than August due to brown coal outages. Victoria’s shortfall was made up for by importing electricity from Tasmania’s pumped hydro plants through the Basslink interconnector.

Victoria’s thermal generation was about seven percent lower than August due to brown coal outages. Victoria’s shortfall was made up for by importing electricity from Tasmania’s pumped hydro plants through the Basslink interconnector.

Peak Futures price (September):

2019: 9.1c per kWh

2020: 6.9c per kWh

2021: 6.7c per kWh