Welcome to the first energy market review of 2021! Australia’s electricity markets are ringing in the new year in a vastly different position to last year. In January 2020 we saw (through bushfire haze) a grid pushed to its limits, multiple major outages and wild price volatility. This year the dominant La Nina weather pattern has largely shielded us from the extreme summer heat. Outages in the thermal fleet have had only short-lived impacts on spot prices and futures markets are remarkably stable. Except for NSW, all futures periods and locations are priced at roughly $40/MWh.

Prices have not been this low in over 5-years, reach out to one of our energy experts to secure contracts now.

| Retail Rates* | NSW | VIC | QLD | SA |

| Peak | 6.8 c/kWh | 6.1 c/kWh | 4.8 c/kWh | 6.6 c/kWh |

| Off-Peak | 4.5 c/kWh | 3.3 c/kWh | 3.7 c/kWh | 3.7 c/kWh |

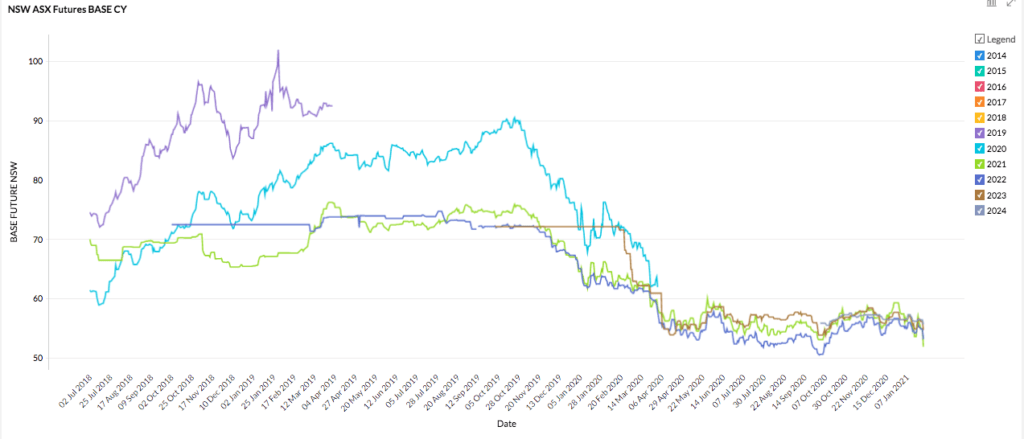

New South Wales

- NSW is trading toward the bottom of its 5-year range but has the highest prices in the NEM at around $52-$56/MWh.

- All contract periods are tightly consolidated with the latter years priced slightly higher.

- Peak futures are trading between $67 and $75/MWh.

How did supply and demand affect price?

- NSW suffered multiple failures within the thermal fleet through December and January. Still, lower temperatures (thanks to La Nina) and increased renewable capacity dampened the impact on spot prices and grid security.

- The problems began on December 17th when a transformer incident at Liddell left a worker seriously injured, causing Unit 3 to be out of action until March.

- Supply is looking solid coming into summer thanks to increased renewable capacity, the primary risks to security will be from flooding and cyclones as La Nina takes hold.

- Later in December and January Origin Energy’s Eraring coal plant was also operating at reduced capacity due to maintenance and technical issues

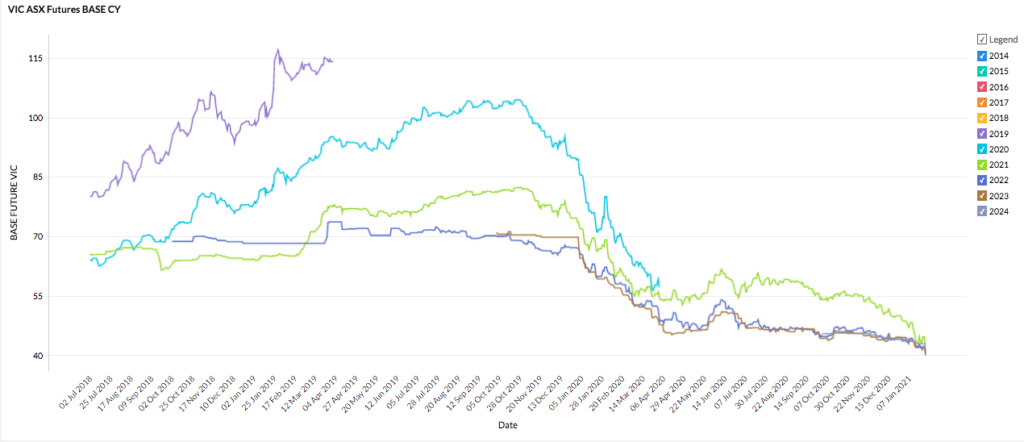

Victoria

- Futures contracts are tightly consolidated around the $40/MWh mark.

- 2022, 23 and 24 have been trading in a largely sideways trend since July with 2021 being the latecomer to the party, falling from ~23% since early December.

- Victorian electricity prices have not been this low in over 5-years

How did supply and demand affect price?

- Victoria was spared the coal-fired outages that beset NSW and QLD and enjoyed low and negative spot prices (as low as -$673/MWh on the 18th December).

- High temperatures in late January had grid operators nervous, but far supply is keeping up, and the RERT has not been called upon for heat-related demand.

- Strong renewable output and low gas prices have put continued downward pressure on prices.

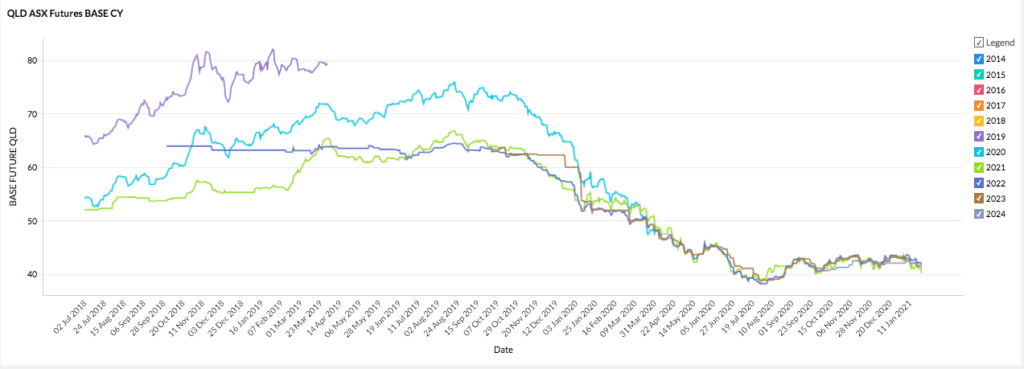

Queensland

- Futures contracts have been flat and low since July 2020.

- All contract periods are trading around $40/MWh.

- Much greater variation exists in peak prices with contracts trading between $49/MWh and $69/MWh with the later years being more expensive.

How did supply and demand affect price?

- Queensland was struck with its own unexpected thermal outage. Two units at Callide C tripped simultaneously on January 13th resulting in some spot price volatility and a drop in mains frequency.

- A spot price spike to $2300/MWh on January 24th resulted from high temperatures and a large drop in collective contribution from large scale solar farms across QLD (possibly related to a technical issue rather than lack of sunshine).

- Low gas prices continue to put downward pressure on spot prices.

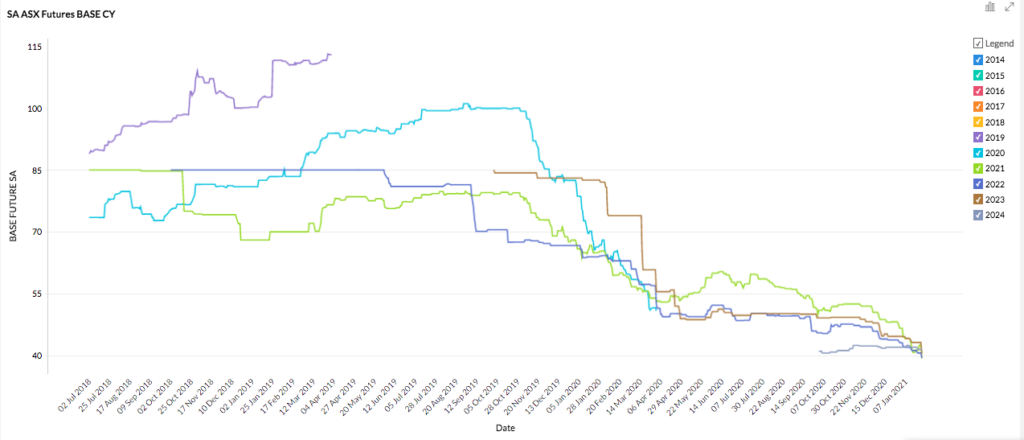

South Australia

- Futures prices are low and consolidated at $40/MWh.

- SA now has among the lowest prices in the NEM having fallen from highs above $130/MWh just 3 years ago.

- Peak prices range from $64-74/MWh with the latter years more expensive

How did supply and demand affect price?

- AEMO data released at the end of 2020 showed renewables contributed 70% of SA’s energy in the final quarter of 2020 – possibly the highest percentage achieved for a major jurisdiction without hydro.

- In mid-January a sudden loss of ~500MW of rooftop solar output (amounting to around 45% of forecast demand) highlighted the state’s vulnerability to sudden fluctuations in renewable output; however, a price spike was not triggered.

The 2021 energy market is off to a calmer start compared to 2020. It seems La Nina, coupled with additional renewable capacity, have eased both supply and demand pressures for now. The small slew of outages in the thermal fleet along with some solar output anomalies in QLD and SA serve as reminders that the NEM is a system amid a massive transition.

With prices at 5-year lows, now is a great time to lock in price certainty. Our Energy Experts are just a phone call away.

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.