Last month the major electricity players threatened a supply response to the rock-bottom wholesale energy prices and this month they delivered. In early March, Energy Australia announced it would bring the closure of its Yallourn coal-fired power plant forward by 4 years to 2028, while at the end of the month AGL announced a demerger that will see it split into two entities according to carbon exposure. In the futures markets, March saw falling prices either stabilise or begin to rise. If you need help navigating the changing electricity landscape, reach out to one of our energy experts today.

| Retail Rates | NSW | VIC | QLD | SA |

| Peak | 7.5c/kWh | 5c/kWh | 5.1c/kWh | 5.5c/kWh |

| Off-Peak | 4.7c/kWh | 2.9c/kWh | 4c/kWh | 3.5c/kWh |

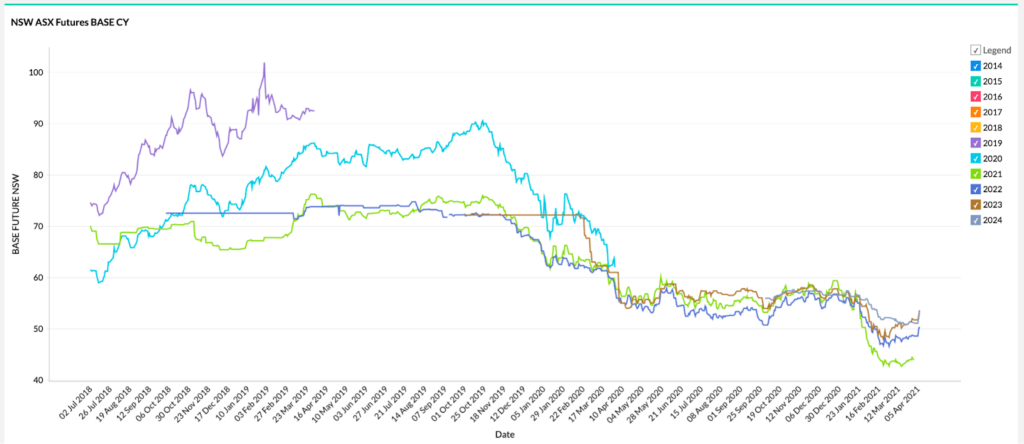

New South Wales

- Prices have begun to rise particularly in the latter years 2022, 2023 and 2024

- 2023 has seen the most marked price increase rising 11% to $53.60/MWh since the beginning of March

- 2021 prices remain very low at $43.90/MWh

How did supply and demand affect price?

- Soft Autumn demand and strong renewable supply kept spot prices low and stable

- AGL announced an extended closure of its Bayswater coal power station which will reduce NSW supply for more than three months.

- The maintenance is in part to increase flexibility so that the plant can participate more effectively in a market increasingly influenced by variable renewables

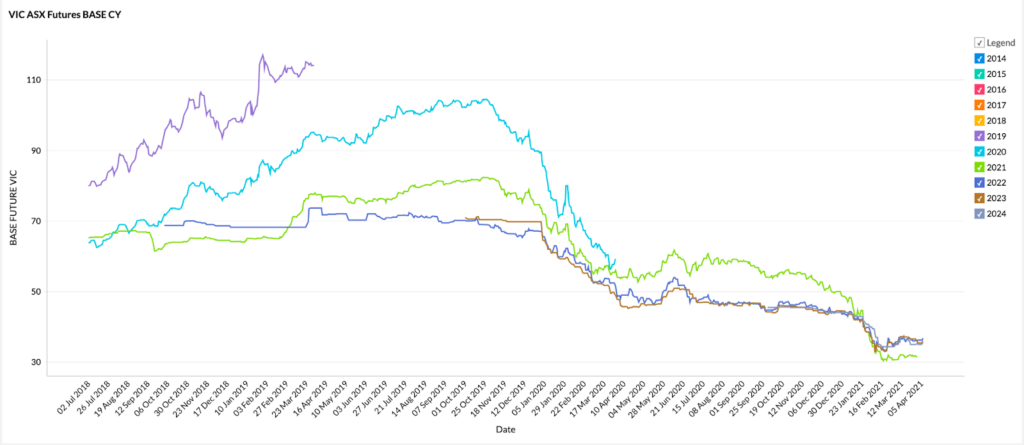

Victoria

- Victorian prices have been low and stable throughout March

- 2021 remains the cheapest contract period currently trading at $31.40/MWh having fallen from over $60/MWh just 8 months ago

- 2022, 2023 and 2024 have been trading between $35 and $37/MWh since the beginning of March

How did supply and demand affect price?

- Data released in March revealed Victoria has reached a milestone in its renewable transition – exceeding 50% of supply in mid-November and mid-January. Cooler weather associated with La Nina assisted the accomplishment.

- The faster than expected renewable transition is a major force behind the pressure on coal-fired plants to remain profitable – highlighted by Energy Australia’s announcement to close Yallourn 4 years early.

- Yallourn currently supplies around 22% of Victoria’s power.

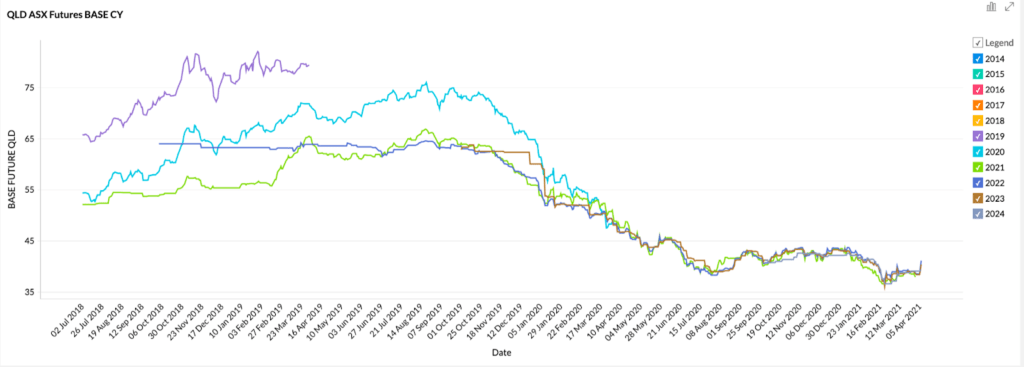

Queensland

- Queensland prices rose around 10% throughout March with 2022 and 2023 experiencing the sharpest rise

- All contract periods are trading between ~$38 and $41/MWh

- As in all other states 2021 remains the cheapest pricing period at ~$38/MWh

How did supply and demand affect price?

- Plentiful supply and mild Autumn temperatures contributed to soft overall spot prices

- A pattern is emerging of spot price spikes (up to $15,000/MWh for a 5-minute interval) around the time that the sun sets. This likely reflects the cost to thermal plants of the rapid ramp-up required to replace diminishing solar supply at the end of every day.

- The Palaszczcuk government announced that it will establish a Ministerial Energy Council to fast track renewable energy projects across the state.

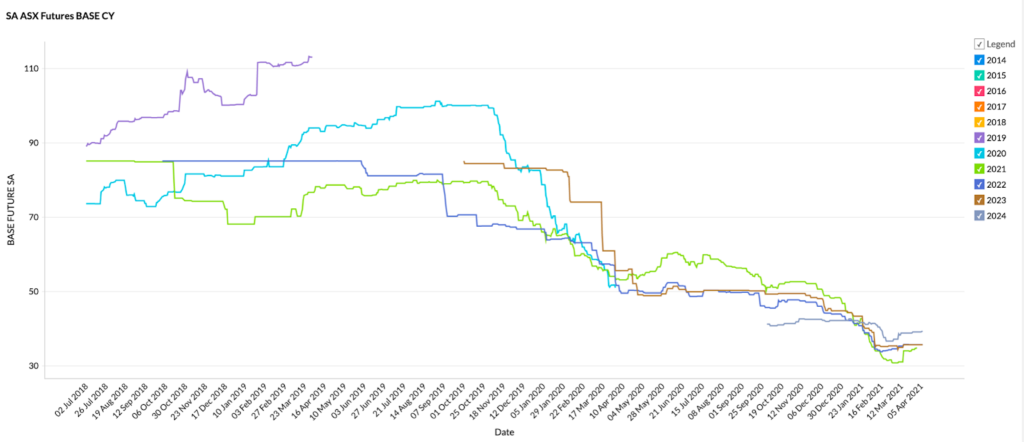

South Australia

- 2022 and 2023 remained low and stable throughout March trading just below $36/MWh

- 2021 rose steeply mid March from ~$31/MWh to $34/MWh while 2024 rose from $37 to $39/MWh

How did supply and demand affect price?

- A major incident occurred on 12 March when equipment failure at Torrens Island and repair work on the Heywood interconnector left the state without 55% of its firm capacity

- Wind conditions were low and as the sun set prices sky-rocketed reaching $14,300/MWh and staying above $1000/MWh for around 6 hours

- AEMO has released a report on the incident which left the State with a very narrow margin of supply relative to demand.

The surge in wind and solar power in the NEM is beginning to squeeze out competitors. Yallourn’s closure and AGL’s demerger signal recognition from the largest players in the Australian energy landscape that the transition away from traditional thermal generation is inevitable. At the same time, the events in SA on March 12 serve as a reminder that states with large renewable capacity are still highly dependent on firm supply. Lock in your low energy cost future today. Our Energy Experts are just a phone call away!

Disclaimer: The information in this communication is for general information purposes only. It is not intended as financial or investment advice and should not be interpreted or relied upon as such.