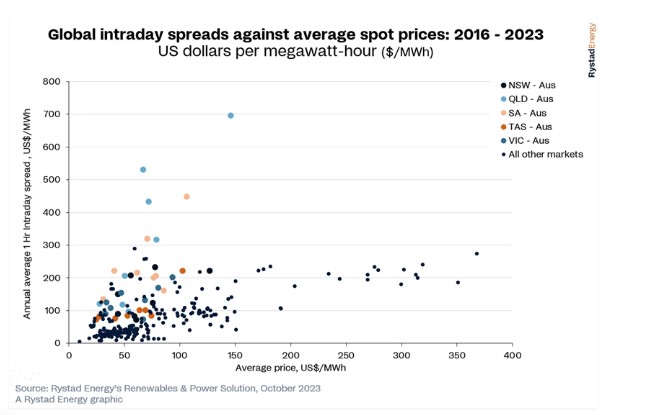

Australia’s National Electricity Market (NEM) continues on an unpredictable journey, taking the title of the world’s most volatile energy market.

Rystad Energy, a leading energy research firm, scrutinised data from 39 electricity markets worldwide. Their conclusion was crystal clear – Australia’s NEM stands out, and not in a good way.

The wild price spreads in Queensland and South Australia are particularly noteworthy.

What does this mean for everyday Australians, and why is this happening? Let’s delve into the details.

Defining Volatility

Volatility is not just some obscure jargon but, in this context, the fluctuation in energy prices, which peak and trough due to supply and demand factors.

Volatility is the difference between the highest and lowest prices per hour. In Australia’s case, it’s off the charts.

- Unplanned Outages

Coal still provides around 60 per cent of Australia’s total energy generation and is still the backbone of the electricity grid. Unplanned shutdowns such as the ones at Callide C, Loy Yang, and potentially Mount Piper hit the market hard, leading to dramatic price swings.

- Natural Disasters

In a land of extreme weather, cyclonic winds and bushfires have become disturbingly frequent.

These catastrophes aren’t just destructive and disrupt energy transmission lines, contributing to the turmoil. Interconnectors are particularly vulnerable, as demonstrated during black summer when South Australia was islanded and cut off the grid.

- Solar Power Surge

Australia is blessed with abundant sunlight, translating into a high solar power output during the day.

While this drives daytime prices down, it leaves a void at night when solar power wanes. Natural gas steps in but at a cost, sending prices soaring.

The Call for Storage Capacity

The NEM needs substantial storage capacity to tame volatility. We’re currently at 2.8 GW of storage, but projections show we’ll need 46 GW/640 GWh by 2050. Australia has around 250 GW of renewable energy projects in the pipeline.

Among these, half are wind projects and there are plans for 60 GW of battery storage. However, industry players complain that processing times are too long and the transmission infrastructure to allow them to function could be much better.

On the other hand, the Australian Energy Market Operator (AEMO) says that many proposals are not tangible and still on paper. At the same time, the actual concrete committed projects still need to come to fruition.

Battery storage is essential to smooth out the bumps in energy generation and ensure supply during high-demand periods.

It’s the buffer we need to protect ourselves from wild price fluctuations.

The Global Picture

The report named Australia the ‘most volatile’ electricity market. However, we’re not alone; Japan, the Philippines, and regions in the US, such as California and Texas, are also highlighted.

The Ripple Effect: Impact on Retailers and Consumers

Volatility is no friend to retailers who must navigate the waters of pricing strategies. Their struggle to hedge against unpredictable costs can be quite a burden.

But it’s the average business and the average Australian who bears the brunt of these volatile prices. Your monthly electricity bill might fluctuate wildly, making it challenging to budget and plan your expenses.

Businesses can forward purchase electricity on the wholesale futures market, which can result in a good deal if the timing is right.

Not leaving it till the last minute before contracts expire to renew and engaging an energy broker to monitor the market and snag a good deal are two effective tactics for businesses to avoid bill shock.

The Way Forward: A Stable and Affordable Market

David Dixon, Senior Analyst at Rystad Energy, recommended a two-fold approach: enhance transmission infrastructure and invest in storage solutions.

These measures can shield us from volatility -some very encouraging figures are on record.

- In September 2023, the NEM saw a remarkable boost in renewable energy, with solar leading the charge. The total renewable energy output hit 7 TWh, a 13% increase from the previous year.

- Solar power was pivotal, contributing 1 TWh more than last September. Wind power remained steady, and hydro generation saw a slight dip.

- New South Wales stood out with 650 GWh of utility solar PV generation, marking a 41% year-on-year increase. The Edenvale solar farm in Queensland took the top spot for utility PV assets.

- Wind generation reached 2,488 GWh, with a 1% year-on-year increase. The leading wind assets were scattered across Queensland and Tasmania, with Victoria, South Australia, and New South Wales taking the state-level lead.

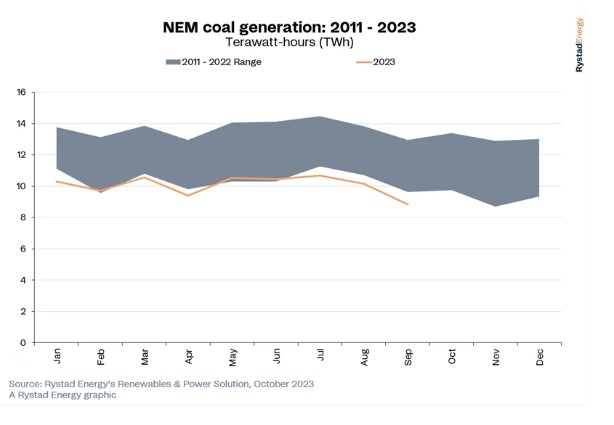

Coal’s Retreat: Historic lows in sight

The story for coal, on the other hand, is very different. Coal-fired generation experienced a dip, primarily due to seasonal factors, increased renewable generation, and outages at coal power facilities.

- In September, coal generation barely reached 0.36 TWh, near the all-time low of 0.35 TWh set in 2022. Within the NEM, coal generation was notably below the historical range.

- Spring typically sees a decrease in coal generation due to milder weather, lower demand, and a surge in solar power, making renewables more cost-effective.

- Victoria’s coal power fleet operated at 74% capacity, with New South Wales at 55% and Queensland at 61%. Several power facilities were offline in September, further contributing to the dip.

Stability is the Goal

The Australian energy market has become a global spectacle of volatility, and it’s time to address this issue.

The answer lies in enhancing infrastructure, investing in storage solutions, and embracing the promising growth of renewable energy.

As the world moves towards a more sustainable future, Australia’s energy market must find its balance, ensuring stability and affordability for all.

The Australian energy market is notoriously volatile; we’ve even held some of the most expensive electricity prices in the world at different times. As our government and industry leaders look into solutions for achieving and maintaining a stable and fair energy market, businesses should also take steps to protect themselves from price volatility.

If you’re a large energy consumer with a monthly spend of $3000 upwards, our energy management consultants can help you find opportunities to manage your usage and costs better. Get started with an obligation-free electricity or natural gas tender by submitting our form here and let’s explore the ways we can shield your business from energy price volatility.

For more inquiries, call us at 1300 852 770 or email us at admin@leadingedgeenergy.com.au.

We source, analyse, compare and rank commercial, industrial and multisite energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.