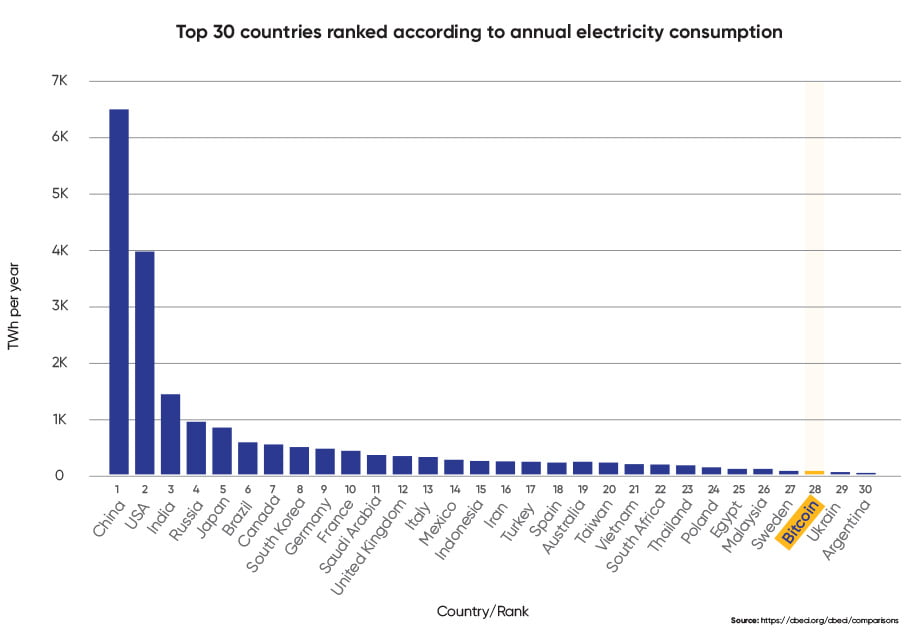

The amount of energy used in the Bitcoin mining business is staggering. Bitcoin’s electricity consumption – at 122 TWh – is above Argentina (121 TWh), the Netherlands (108.8 TWh) and the United Arab Emirates (113.20 TWh) – and it is gradually creeping up on Norway (122.20 TWh). Australia consumed 192 TWh in 2019-2020.

When lined up against all national energy consumption charts, Bitcoin mining would be placed at number 30 out of all countries in the world according to a study released by Cambridge University.

To give that some further perspective, the energy it uses could power all kettles used in the UK for 27 years.

On the other hand, the study also suggests the amount of electricity consumed every year by always-on but inactive home devices in the US alone could power the entire Bitcoin network for a year.

Electricity consumption is only going to get higher as the division of Bitcoin gets smaller and smaller.

But as long as power is cheap enough to make production costs cheaper than the value of 1 Bitcoin (AUD 71,600), the potential is there for it to take hold in Australia.

To mine Bitcoin, computers have the job of verifying transactions made by people who send or receive Bitcoin.

This process involves solving puzzles, which, while not integral to verifying movements of the currency, provide a hurdle to ensure no-one fraudulently edits the global record of all transactions.

But it is not enough to solve the puzzles, you must solve them first, before anyone else, to receive the Bitcoin reward. And the amount of electricity needed to mine Bitcoin is only going to get exponentially higher as time goes on.

How are new bitcoins issued and mined?

New bitcoins are released to successful problem solvers every 10 minutes. To keep the flow steady, the software adjusts the difficulty of the problem to counteract the increasing power of computers trying to solve it.

The cap for Bitcoin is 21 million and most have already been mined. The 17th million Bitcoin was released in April 2018 and the gradual slower release of the rest means that the final Bitcoin will not be mined until around 2140.

By that time, Australia will have probably surpassed its 2050 target of 50 percent renewables target. But if the Bitcoin mining industry does come to Australia with its glut of low wholesale electricity prices, operators must be wary and enter deals with providers that offer price protection.

If demand suddenly goes through the roof and supply is restricted, the costs of mining could put them out of business, even if they do offset by selling back into the grid.

Are you looking for help powering your bitcoin mining operation?

Given the amount of electricity needed to power cryptocurrency mining rigs, taking a smart and strategic approach to electricity procurement is a must. Here are a few things to consider to minimize the cost of electricity for your cryptocurrency mining operation:

- Usage Analysis: Current and expected electricity demand of your operation. Analysis based on Time or Day and Time of Year

- Location specification: Geographic location of your rigs in terms of state and network.

- Electricity Procurement: Selection of an appropriate electricity supplier who can provide a suitable contract structure and low rates.

- Demand Response Procurement: Identification and negotiation of a Demand Response product.

- Technology: To monitor and control the electricity usage of your cryptocurrency mining site.

Leading Edge Energy’s Energy Experts can help you create, execute, and maintain an energy management plan that will ensure your crypto mining operation is running more efficiently, saving you money off your electricity bills.

Sound good? Sign up here or learn more about our services by calling us at 1300-852-770 or dropping us an e-mail at hello@leadingedgeenergy.com.au. We’re ready to help.

We source, analyse, compare and rank commercial, industrial and multisite energy quotes. Obligation Free.

Chat with one of our experienced consultants today and get the insights your business needs to help manage the risks associated with volatile electricity and natural gas markets. Our energy procurement service is obligation-free and provides a time-saving way of securing lower energy rates from our panel of energy retailers.