Hopes of an early return to normal economic life faded in July as the second wave of Coronavirus rolled across Victoria and possibly into NSW. Energy futures markets have largely taken the news in stride with none of the sharp price movements that accompanied the first wave. Experience has shown that lockdown conditions are unlikely to cause major disruptions to energy demand in Australia as has occurred in other countries.

COVID-19 has also failed to slow the booming rooftop solar market with July setting a new record for rooftop solar installations at 275MW! Businesses are continuing to lock in long-term energy contracts at these low prices. Get in touch now to join in on the savings.

Indicative retail prices*

| Indicative Rates | NSW | VIC | QLD | SA |

| Peak | 6.9c/kWh | 6.0c/kWh | 4.7c/kWh | 6.0c/kWh |

| Off-peak | 4.8c/kWh | 4.0c/kWh | 3.7c/kWh | 4.5c/kWh |

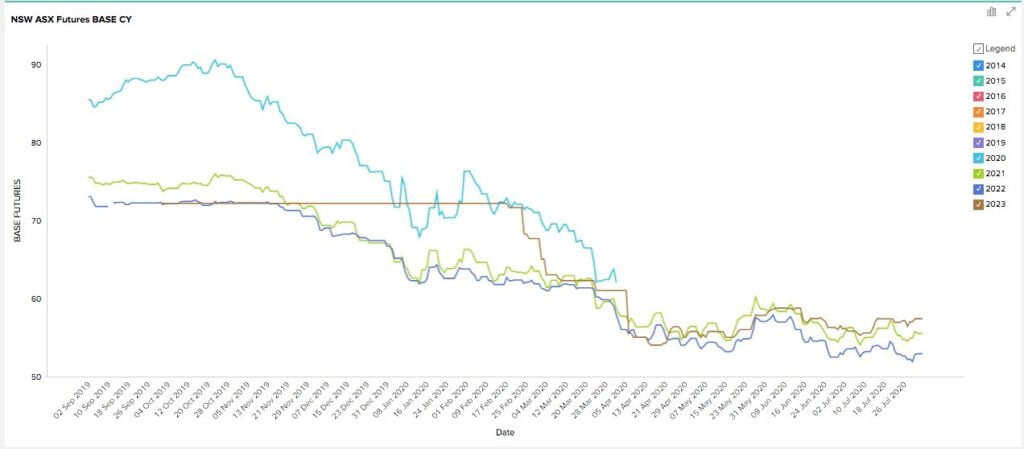

New South Wales

Key Points:

- Energy futures contracts are continuing to bounce around within a $50 to $60/MWh range which has been established since late March.

- Before COVID-19 these contracts (2021, 2022 and 2023) had rarely traded below $70/MWh and are all 17-20% down on January prices.

How did supply and demand affect price?

- Spot prices have been low and stable thanks to a mild winter and no major outages for the month, the average price for the month was under $50/MWh.

- Origin’s Eraring coal-fired plant in NSW (the largest in Australia) has been operating at close to its minimum generating capacity thanks to COVID-19 and distributed energy pushing down operational demand.

- NSW saw a new record set for small-scale home solar installations in July. With more people working from home, it is likely that a larger portion of home solar generation is being consumed behind the meter.

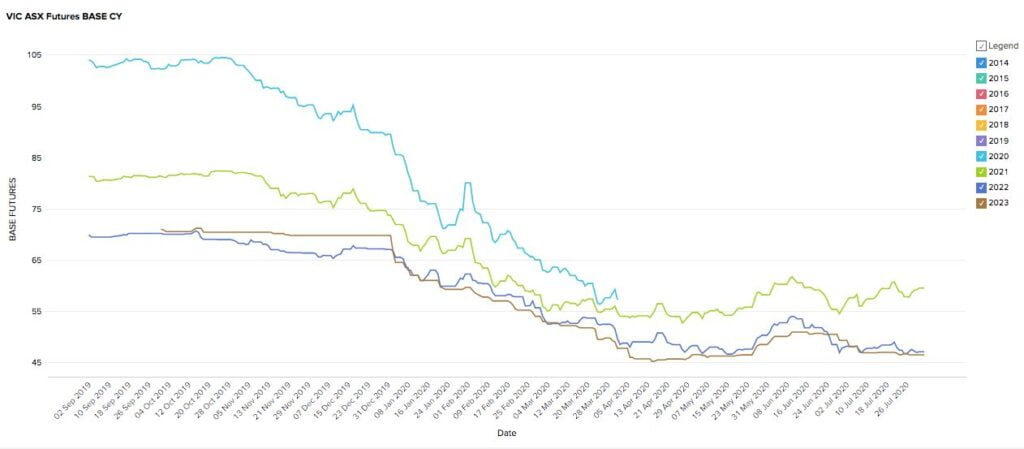

Victoria

Key Points:

- 2021 prices have increased by around 10% over July to ~$60/MWh.

- 2022 and 2023 prices stayed low and flat around $46-47/MWh.

- Prices for all periods are well below historical averages.

How did supply and demand affect price?

- Victoria went into stage 3 lockdown driving energy demand in the commercial sector down. Still, these reductions are offset by increased energy use in the residential sector as people work from home.

- Large industrial energy users such as the Portland smelter have continued to operate as usual with increased safety measures.

- Supply has been good with no significant outages. However, wind output is down on the same period last year.

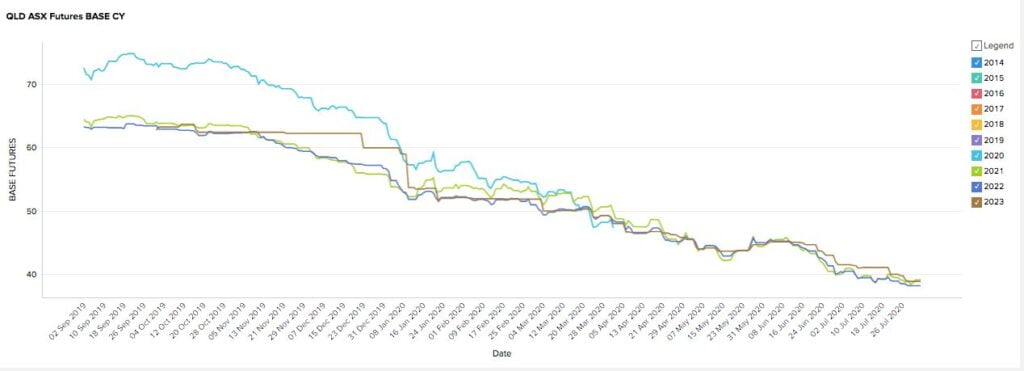

Queensland

Key Points:

- Queensland continues to have the lowest and most stable prices in the NEM.

- Contract prices for all periods are tightly consolidated around the $39/MWh mark.

- Prices have not been below $40/MWh in the last 7 years.

How did supply and demand affect price?

- Low coal and gas prices, along with increased renewables, are the primary drivers of low spot prices.

- Despite Queensland being one of the better performers in terms of COVID-19 cases, AEMO’s analysis has determined it to be the hardest hit by demand reduction with a 4.8% drop. This demand reduction is in part due to reduced LNG exports.

- Queensland solar installations continue to boom with a record number of installations in July.

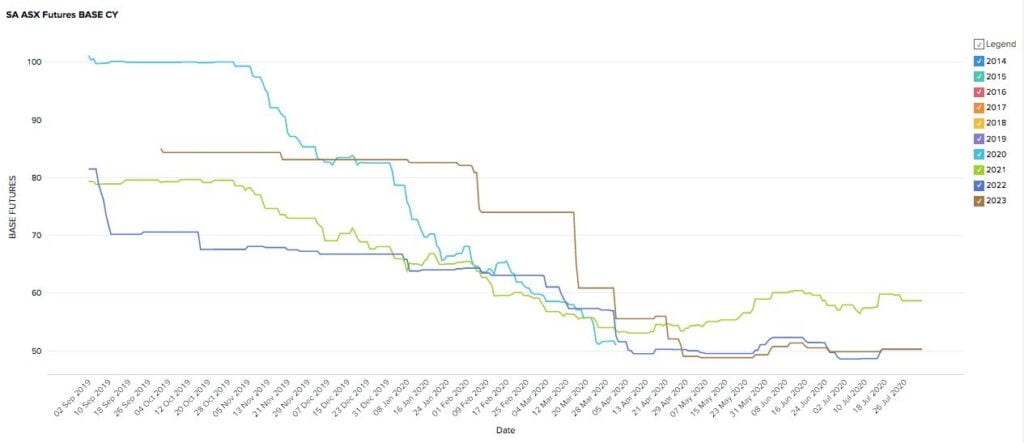

South Australia

Key Points:

- 2021 prices have risen since the lows of March and April and are currently trading around $58/MWh.

- 2022 and 2023 have remained flat and low since April, currently trading around $50/MWh.

- All periods are still trading well below historical averages.

How did supply and demand affect price?

- Spot prices are up to slightly above the same period in 2019

- Demand has increased due to cooler temperatures, and there is minimal disruption from COVID-19 in SA.

- Wind production is down on the previous corresponding period despite increased capacity.

In Summary

July was a fairly flat month for the electricity sector and the national mood. It is becoming clear that the Coronavirus crisis is going to be a marathon, not a sprint and businesses and markets have settled into a groove awaiting any meaningful news. In the meantime, locking in long-term, low-cost electricity contracts is a practical step businesses can take to reduce outgoings.